A Contingent Liability That Is Probable and Can Be Reasonably Estimated Must Be

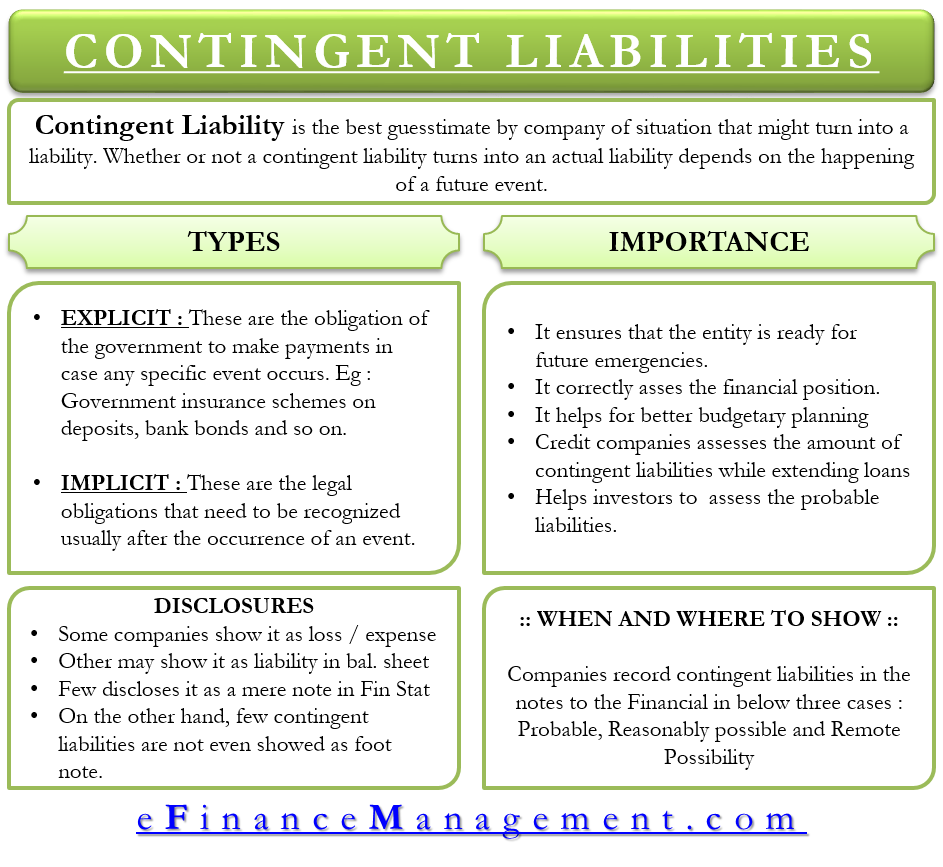

Contingent Liability is the all-time guesstimate past the company of a situation that might turn into a liability. Whether or not a contingent liability turns into an bodily liability depends on the happening of a future consequence. Suppose an employee sues a visitor for $100,000. Whether or not a visitor volition pay this amount depends on the result of the instance.

Companies create a provision for a contingent liability in anticipation of whatsoever time to come liability or liabilities. By making a provision, the company's makes sure that they are ready for whatsoever such situation even if such liability may or may not occur.

Table of Contents

- Types of Contingent Liability

- Explicit

- Implicit

- Importance of Contingent Liabilities

- Disclosure

- When and Where to Record?

- Probable

- Reasonably Possible

- Remote Possibility

- Contingent Liabilities and Inspect

Lets' understand the concept with the help of a uncomplicated instance. A company takes a guaranteed loan from a bank to run its business organization. In case, the company fails to make the payment, the bank would sell the assets that the company has put as collateral. And so, the company makes some provisions to avert the situation of default.

There could be various forms of contingent liabilities that the company might have to make provision for. Some of the examples are fulfilling the warranty claims by customers, whatever potential lawsuits or any other class of investigations.

Types of Contingent Liability

There are ii types of contingent liabilities:

Explicit

Such liabilities are the obligation of the government to make payments in case any specific event occurs. Assessing the explicit contingent liabilities could be tough since these items practise not announced until they occur. Such liabilities are a huge burden, and therefore could be a drain on the future government finances. Some of the examples of explicit contingent liabilities are:

- Government insurance schemes on deposits, bank bonds and so on.

- Mortgage Loan, student loan, civil service pensions etc.

- Central Authorities guarantees for non-sovereign borrowings.

- Currency substitution rates.

- Any likely case wherein the court orders to pay the penalisation or specific sum of money towards specific cases.

Implicit

These are the legal obligations that need to be recognized normally after the occurrence of an issue. The government does not officially record such contingent liabilities as there is no certainty of their occurrence. Few examples are disaster relief (Floods, Cyclones, Tsunami and more), environment management, municipality defaults and so on.

Importance of Contingent Liabilities

- Recording contingent liabilities ensure that the companies, government, and not-government organizations are ready for any emergency in the future.

- Recording such liabilities help to correctly asses the financial position of the economic system or the company.

- It helps a company or government to improve plan its upkeep.

- Credit companies also consider the amount and nature of contingent liabilities while extending a loan to a company.

- Earlier making an investment, investors might also want to know the likely liabilities that the company might take to pay in the future.

Disclosure

Companies and other entities may record a contingent liability equally a loss or expense in the income statement. The organizations may also show it as a liability on the balance sheet. In some cases, a company may also disclose such liabilities by a mere note in the fiscal statements. Whether or not the company shows such a liability in the income argument or balance sheet depends on certain criteria (discussed afterwards in the article).

On the other hand, in that location are a few contingent liabilities that companies don't show it in the financial argument or even as a footnote. For example, a example against a company that has nigh zippo chances of getting proved (on the basis of celebrated success rate of such cases against the companies).

When and Where to Record?

Companies record the contingent liability every bit a annotation to the financial statement or in the books in the following cases:

Probable

As the name suggests, the company might be expecting the liability to occur in the future. Likewise, the company will be able to estimate the loss corporeality due to such liability to a sure extent. Product warranties are a good example of this. Companies show such liabilities in the financial statements.

Reasonably Possible

Organizations may record the beingness of such contingent liabilities in case they believe there is a reasonable possibility of any liability to occur but not probable. Since it is not possible to quantify such liabilities, companies show them as notes.

Remote Possibility

Companies don't need to tape the liabilities that are only remotely possible to happen. Such liabilities don't come in the books nor practise the company shows it in the notes.

Contingent Liabilities and Audit

Companies should go through the inspect process to protect the integrity of the financial system. Audit becomes more important in the example of companies dealing with securities and loans from 3rd parties. Auditors should closely lookout man the contingent liabilities to confirm the claims of the visitor. And, if they find no mismatch, they must approve the claims.

In instance the auditor finds some misappropriation or wrong claim as a contingent liability in the company's account, it is their duty to rectify it. An auditor should never take the give-and-take of the company at its face value and always do their due diligence.

Forth with determining the likelihood of any contingent liability, an auditor must decide the materiality of such liability. The materiality here means the touch on that information technology could accept on the company if it occurs. For case, $g liability is not material for a company like Apple tree even if it has a 95% chance of occurring.

So, after determining the materiality, it is up to the company and auditor to decide how or if they want to prove it in the books. In the Usa, FASB (Financial Accounting Standards Lath) lays downward the criteria of how to assess, disclose and inspect contingent liabilities.

Help us brand this commodity better

Source: https://efinancemanagement.com/financial-accounting/contingent-liability-meaning-importance